Wealth creation made easy and transparent

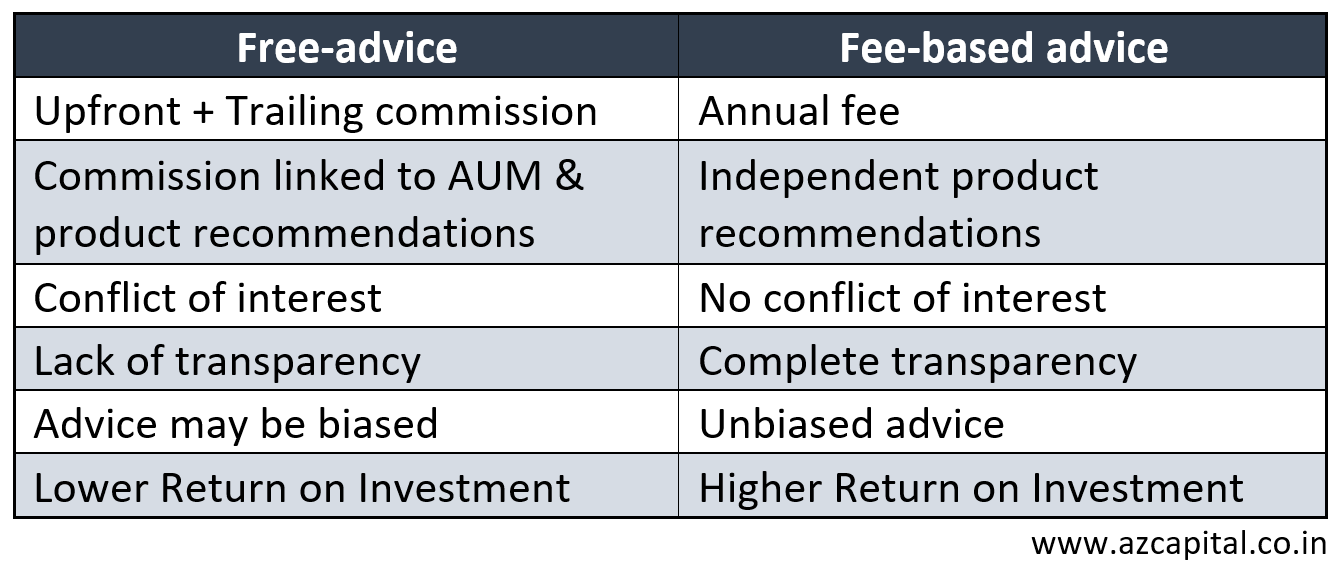

When financial advice is easily available free (as many believe it) from family, friends, colleagues and online, then what can be the reason for paying a fee for getting it? Many in India think like this. There is a general notion that financial advice should be free. But this isn’t correct. If you are taking advice from a Fee-Only Investment Advisor that means you will be paying them for getting financial advice. Just like a patient goes to a doctor and pays a fee after getting proper diagnosis done & prescription from Doctor. Since fee-only adviser is being paid only by the client, he will work only for the client. He will not be affiliated with any organization, mutual funds AMC, insurance companies. There will be no hidden commissions or sales incentives to influence the advisor’s investment recommendations. And that is something really worth paying for – getting proper and conflict-free financial advice.

If someone is offering free advice to you, it clearly means that he is earning from some other source. And that source will be commissions from the sale of products which he sells along with doling out random free financial advice.

Why this is problematic?

Because these product sellers (like MF distributors, insurance agents and bank relationship manager) are motivated to maximize their earnings/profit and do not always have your best interests at heart. If some product is not suitable for you but gives them a higher commission, they most likely will sell you that product. And that is unethical on their part and more importantly, can result in financial disasters for you. The major benefit of taking advice from fee-only investment advisor is that they do not sell financial products like mutual funds or stocks or insurance themselves. Instead, they provide recommendations via a well-thought-out, solid financial plan and guide you to implement it yourself. And the best part is that unlike product sellers, a fee-only financial advisor will always look at your whole financial picture instead of trying to sell random products. A commission-based product seller, on the contrary, gets paid for selling financial instruments like stocks, bonds, mutual funds and annuities and not for giving you financial advice. And this is very important to understand as it shows where the hearts of these product sellers (MF agents, insurance agents, Bank RMs) is.

Think it in this way: If you go to purchase a car in a Hyundai showroom, you can’t expect the salesman to say, ‘I have understood your requirements. I think an Audi might be a better fit for you.’ This won’t happen. Never. The Hyundai salesman earns only if you purchase a Hyundai and not an Audi. It is plain and simple. The same is the case with commission-earning agents. They earn only if you purchase the product from them (and take their free advice). It is not necessary that what they are selling is best for you.

And this where AZ Capital comes & will tell you what is really best for you. As we are not getting a commission from anyone. Only you pay us.

On the other hand, a fee-only financial advisor like us will go much beyond just the selection of investment products and their returns. They will give you the right advice you need for saving for your financial goals, retirement planning and having proper insurances in place. They will evaluate your current financial position and create a plan of action for methodically achieving your financial goals. They help make the right money decisions each time and help you avoid making financial mistakes. And since these fee-only advisors aren’t preoccupied trying to sell you something to earn their big, hidden commission, you can be sure that you are getting their full attention and the right advice.

So, if you are still undecided or want to know more about our Investment Advisory Services, then simply connect with us. We will reach out to you & happy to assist.